If you’re ready to file, please feel free to request a free consultation so we can help you take care of your tax filings. “Being ‘in’ a tax bracket doesn’t mean you pay that rate on everything you make.” Next Steps… In other words: Take all the tax deductions you can claim - they can reduce your taxable income and could kick you to a lower bracket, which means you pay a lower tax rate. So if you fall into the 22% tax bracket, a $1,000 deduction saves you $220. Deductions lower your taxable income by the percentage of your highest federal income tax bracket. Tax deductions, on the other hand, reduce how much of your income is subject to taxes. Tax credits directly reduce the amount of tax you owe they don’t affect what bracket you’re in. Two common ways of reducing your tax bill are credits and deductions:

Us federal tax brackets 2021 how to#

How To Get Into A Lower Tax Bracket & Pay A Lower Federal Tax Income Rate

The beauty of this is that no matter which bracket you’re in, you won’t pay that tax rate on your entire income. The government decides how much tax you owe by dividing your taxable income into chunks - also known as tax brackets - and each chunk gets taxed at the corresponding tax rate.The progressive tax system means that people with higher taxable incomes are subject to higher tax federal income tax rates, and people with lower taxable incomes are subject to lower federal income tax rates. Being “in” a tax bracket doesn’t mean you pay that federal income tax rate on everything you make.

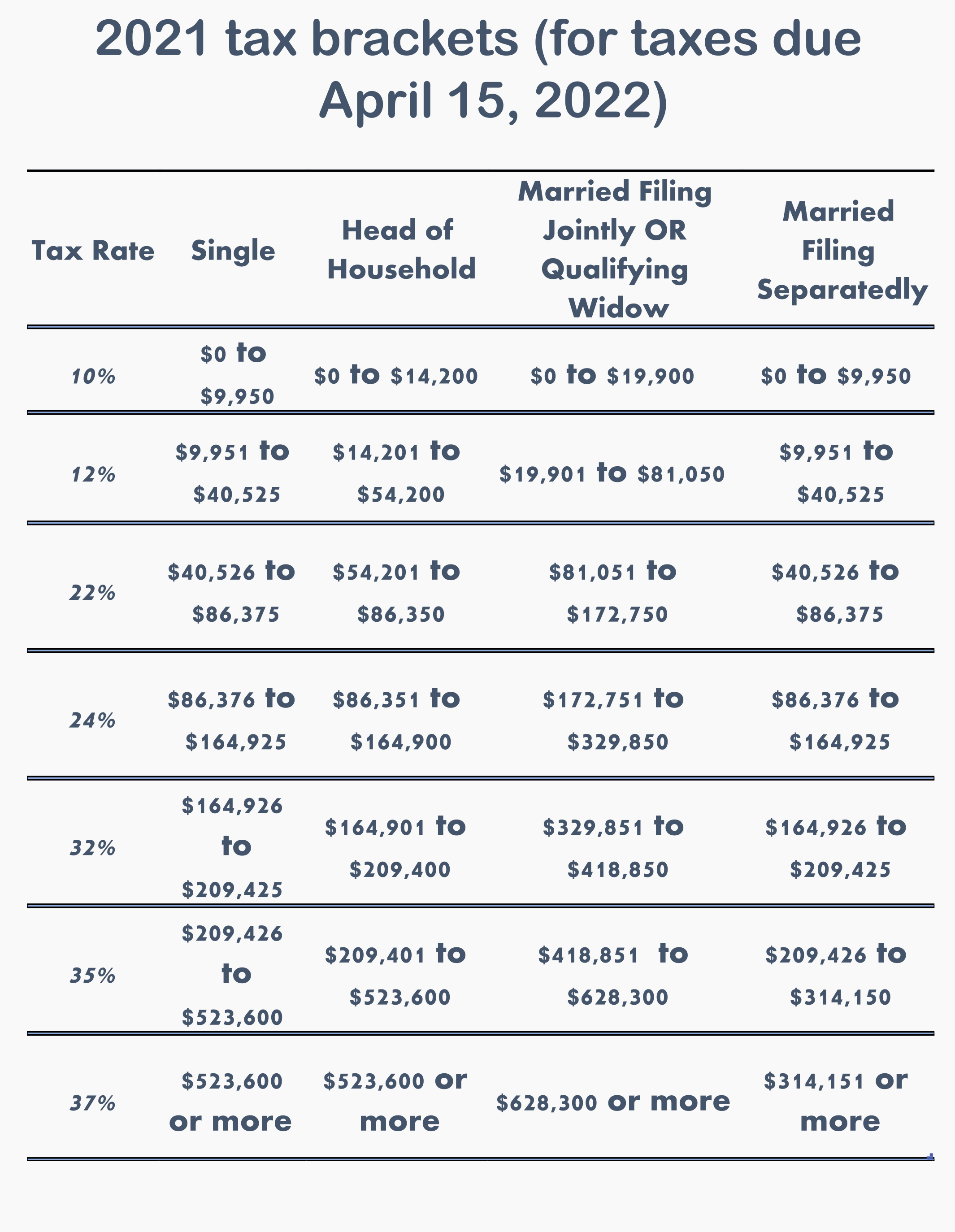

The United States has a progressive tax system, meaning people with higher taxable incomes pay higher federal income tax rates. Single Filers Married, Filing Jointly Married, Filing Separately Head Of Household How Tax Brackets Work Our table shows the tax brackets and federal income tax rates that apply to the 2018 tax year and relate to the tax return you’ll file in 2019. The bracket depends on taxable income and filing status. If the nonresident individual is going to be taxed at a higher rate than their financial circumstances would require if they filed individually, the individual can file a nonresident return (Form NJ-1040NR).įor more information, see the instructions for the New Jersey Composite Return (Form NJ-1080C) or the New Jersey Nonresident Return (Form NJ-1040NR).Keep up to date on the latest changes in the federal income tax brackets with Brilliant Tax. Participation in a composite return is elective.

Note: For Tax Year 2017, the highest tax rate was 8.97%. Therefore, the composite return, Form NJ-1080C, uses the highest tax bracket of 10.75%. Since a composite return is a combination of various individuals, various rates cannot be assessed. New Jersey has a graduated Income Tax rate, which means it imposes a higher tax rate the higher the income. Technically, it is an individual return that each nonresident income earner must file, except that it is a composite filing of all the individual returns on one form. Tax Rate for Nonresident Composite Return (Form NJ-1080C)Ī composite return is a group filing. Use the correct schedule for your filing status. You must use the New Jersey Tax Rate Schedules if your New Jersey taxable income is $100,000 or more. Tax Rate Schedules (2017 and Prior Returns) Tax Rate Schedules (2020 and After Returns) When using the tax table, use the correct column. If your New Jersey taxable income is less than $100,000, you can use the New Jersey Tax Table or New Jersey Rate Schedules.

0 kommentar(er)

0 kommentar(er)